Marketing Your Business Through an Economic Correction

Australia has seen tough economic times since COVID-19. The Reserve Bank is fighting hard to keep inflation under control, but there are signs we could still see a recession in 2024/25.

That’s a scary reality for business owners. Economic corrections mean customers spend less, and brands start looking for ways to save money.

Many businesses cut their marketing budgets first. It seems like an easy place to save some cash. But marketing is one of the primary streams of new customers, so reducing your budget can actually harm your business.

So if cutting your budget isn’t the answer, how can you effectively market your business through an economic correction?

What actually happens to customers in an economic downturn?

Understanding your customers is the foundation of any marketing strategy. It becomes even more important when customers are feeling the pinch.

The tricky part is that consumer psychology changes when the economy weakens. As confidence dips, customers limit their spending, trust in brands decreases, and people learn to embrace more frugal lifestyles.

It’s more than an issue of money. It’s an issue of uncertainty.

As marketers, we often talk about segmenting customers based on their demographic. But we can also segment based on behaviour, and that’s an important part of marketing when the economy is tough.

The Harvard Business Review separates customers into four categories during a downturn:

- Slam-on-the-brakes customers are the hardest hit, or they otherwise feel very vulnerable during a downturn. This type of customer is most likely to dramatically reduce their spending and decrease or delay purchases.

- Pained-but-patient customers are cautiously optimistic about the future, but they rein in spending anyway. This applies to the majority of households during an economic correction.

- Comfortably-well-off customers can maintain their standard of living with minimal changes. They may put off or reduce large purchases, but their consumption levels remain steady.

- Live-for-today customers typically don’t change their spending habits. They may extend their timeline on major purchases, but otherwise they see no need to be concerned about the downturn.

Understanding where your customers fall on this scale can help you re-strategise your marketing efforts.

Economic corrections are a chance to increase market share

Did you know you can actually gain market share in an economic downturn?

Opportunities are everywhere. Even when your customers rein in their spending. At least, that’s what the Harvard Business Review found in a 2010 study.

The study compiled economic data from the recessions that occurred in 1980, 1990 and the year 2000. This data followed 4,700 public companies to see how they performed in the aftermath of these recessions.

And the results were interesting:

- 21% of companies that slashed their budgets were able to rebound to pre-recession levels of success. Companies that cut their spending faster and deeper than competitors were the least likely to recover from the recession.

- Companies that invested heavily during the recession also struggled to come out the other side, although they enjoyed more success than the first group.

- Firms that cut unnecessary spending while also investing in new streams of revenue had the highest probability of recovering from an economic correction.

According to the study, the most successful companies focused more on operational efficiency rather than cost cutting, while continuing to invest in marketing, R&D and assets.

That sounds counterintuitive, but it makes sense. When other companies slash their budget, the right marketing moves can help you gain a foothold and win customers that you wouldn’t have access to otherwise.

Finding the right balance is challenging. The only sure thing is that cutting your budget will cost you customers in the long run.

How to market your business through an economic correction

1. Figure out whether your product is a necessity

Most customers change how they spend money in a recession. This is based on whether products and services are perceived as a necessity:

- Essentials – These items are required for survival and well-being. This includes shelter, food, clothing, transport and medical care.

- Treats – These items are justifiable indulgences. This includes eating out, your morning coffee, gym memberships and subscriptions.

- Postponables – These items are the things we want that can easily be put off. This includes consumer electronics, furniture, luxury items and clothing,

- Expendables – These items are unnecessary and/or unjustifiable for the customer. This includes art, jewellery, consumer electronics, alcohol and home decorations.

Every customer has a slightly different perception of their consumption habits. For example, one person might consider their gym membership to be a Treat, while another could consider it an Expendable expense.

It’s up to you to perform market research and figure out how customers perceive your brand. You can do this by reaching out and asking questions, distributing surveys or contacting some of your loyal customers directly.

2. Reassess your market and develop a new strategy

Every marketing campaign begins with a strategy. The largest part of this work involves assessing your audience.

You need to know all the normal things about your customers. Who are they? What are their demographics? Why do they need your products and services?

But we also need to know what type of customer you’re dealing with and how they’ll react to the economic uncertainty. You can use this table to get a rough idea of how your customers will behave:

| Customer Segment | Demographics | Reaction to Economic Uncertainty |

| Slam-on-the-brakes | Younger demographics, older demographics, lower-income earners | Reduction in spending on necessary items, deep reduction in spending on unnecessary items |

| Pained-but-patient | Young professionals and middle aged demographics, middle and high income earners | Minor reduction in spending on necessary items, cautious spending on unnecessary items |

| Comfortably-well-off | Middle aged and early retirement demographics, high income earners | Minimal change in spending habits, minor reduction in spending on unnecessary items |

| Live-for-today | Younger demographics, few responsibilities | Minimal change in spending habits |

Once they know how your customers are likely to react, you can create offerings that will continue to generate sales, even when times are tough.

3. Create offerings that add value for customers

Most people fall into the “pained-but-patient” category. They will slightly reduce their spending on essential items, and pay special attention to spending on treats and expendable items.

If you want to keep the sales rolling in, your marketing campaign needs to create value for your customers. This could involve:

- Decreasing costs to lower your price point

- Providing lower-cost alternatives to your normal products

- Providing do-it-yourself alternatives

- Rewarding customer loyalty

- Communicate what customers are getting for their money, e.g. quality and value

- Provide discounts that encourage customers to buy now rather than delaying the purchase

These tactics go hand-in-hand with your digital marketing strategy.

Paid advertising is the perfect way to spread the word about your updated offerings. Running ads on Google or social media will generate immediate results, and you can use that revenue to reinvest in other areas of your business.

Be careful not to focus all your energy on short-term marketing strategies though. Long-term strategies like SEO need regular maintenance, or you could be overtaken by competitors that are investing in these areas.

4. Strengthen customer trust

Trust is the foundation of any successful business. When customers trust your brand, 57% of people spend more, and 76% say they’re more likely to choose you over a competitor.

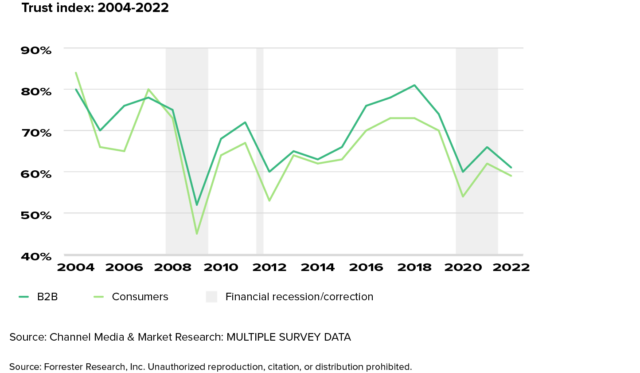

That’s crucial when times are tough because trust drops significantly during economic corrections. This graph from Forrester shows a huge dip in consumer trust during the 2008 and 2022 recessions:

You can build trust in lots of ways, including:

- Being transparent about your brand

- Being honest about products and services

- Sharing your customers’ core values

- Showcasing your actual leadership and team members

- Showing empathy for your customers

- Developing a brand personality that helps customers relate to your business

- Providing excellent customer service

Make sure you review your customer trust and adjust your messaging when times are tough. This may mean acknowledging and showing empathy for your customers’ financial situation, and coming up with ways you can help.

You can take it a step further by sharing these trust measures through your marketing.

While things like brand awareness campaigns often take a backseat during a downturn, these are important to maintaining sales and your long-term performance. If possible, you should continue to run awareness campaigns through platforms like Google Ads.

This type of campaign is effective in spreading your brand and while it may not lead directly to sales, it can make the difference when it comes to attracting new customers.

5. Put yourself in a position to recover

Recessions always end. The worst thing you can do is narrow your focus and forget about the coming years.

It’s important to position your business to recover as quickly as possible. This means:

- Continuing to invest in marketing and R&D

- Staying competitive through tactics like SEO

- Being prepared for a long-term change in how consumers act and make purchase decisions

- Maintaining corporate responsibility by being honest and creating value for your customers wherever possible

Remember that statistic from earlier – companies that find a balance between cutting costs and investing in the business are the most likely to thrive. If you can strike that balance, you’ll set your business up for short and long-term success.

Keep your business on track with Gordon Digital!

Marketing your business during a recession is the best way to survive a downturn. While it might sound counterintuitive, investing in your business means the sales continue rolling in.

The only trick is to assess how your customers change when they’re doing it tough. This usually means they’ll reduce their spending and your business will need to adjust its plan accordingly.

While you might create special offers and promotions, it’s important not to stop your marketing completely. You may simply need to reassess and make sure you’re spending your budget in the right places.

If you’re unsure where to start, get in touch with Gordon Digital! We’re digital marketing specialists that help businesses with SEO and paid advertising.

We’re no strangers to economic corrections. When times get tough, we can help you make the most of your budget and turn it into sales that keep your business growing.

Contact us to learn more and to book your strategy session!